In a recent article posted on The Atlantic Cities blog, urban studies theorist Richard Florida (most well known for his 2001 book, The Rise of The Creative Class) examines the new geography of finance within the United States.

He writes: "The 2008 financial crisis set in motion shock waves that are still reverberating through the American, European, and global economies, touching everything from housing to jobs to college tuition... Several years into the crisis, I wanted to look at how the crisis might have affected the geography of finance across America."

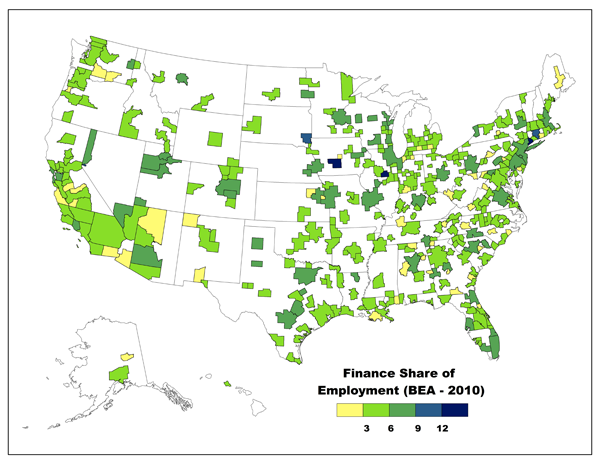

Florida's findings, which he compiled with the help of Charlotta Melander of the Martin Prosperity Institute, caught my attention. He writes that while the Greater New York Region is by far the largest financial center in the USA (with nearly half a million people working in finance-related occupations!) it ranked only 18th in a map charting "the share of total regional employment composed of people who work in all finance-related occupations." Only 5.8% of the New York workforce falls into this category. In Washington, D.C., by contrast, financial occupations make up nearly 10% of local employment.

In what ways, then are the cultures of cities defined by their leading industries? New York represents the financial capital of the United States, but can we define it as a financal city? To what extent is the Big Apple shaped by Wall Street?

These questions came up a few times while I was conducting my research among graduate students in computational finance this past September. The students enrolled in this particular program had the option of completing their degree at the university's main campus (in Pittsburgh) or at its satellite campus in New York City.

So, I asked, why did students choose New York?

For the most part, it was a calculated professional choice. The students acknowledged that daily on-campus access to professors might have had its advantages, but that these were minimal when compared to the benefit of living and studying in such close proximity to so many potential employers. Said one first-year student, “This is where the industry is. It's all about broadening your net. .. I'm here to get a job. It's not about my GPA, it's about networking and taking advantage of every opportunity.”

At the same time, other students told me that New York itself, as a complete city which happened to contain a financial hub, was the primary attraction. "I read a lot about New York and how rich it is in culture and opportunities, the melting pot of the whole world, the biggest financial center in the West and possibly the world, so .. it looked like the big league," another first-year explained. "So that's why I decided to move here....You walk down the street, you hear tens of languages, skyscrapers, the city is very rich in all aspects, not only in cash."

This last sentence leaves me wondering: to what extent can we parse through these various aspects of richness? And how can we qualify, or perhaps even quantify, non-material wealth?

|